Red Flag Rules Banking . learn about the 26 red flags that indicate possible identity theft and how to respond to them. the red flags rule requires each financial institution and creditor that holds any consumer account, or other. learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and. on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft.

from www.slideserve.com

on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. learn about the 26 red flags that indicate possible identity theft and how to respond to them. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. the red flags rule requires each financial institution and creditor that holds any consumer account, or other. learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft.

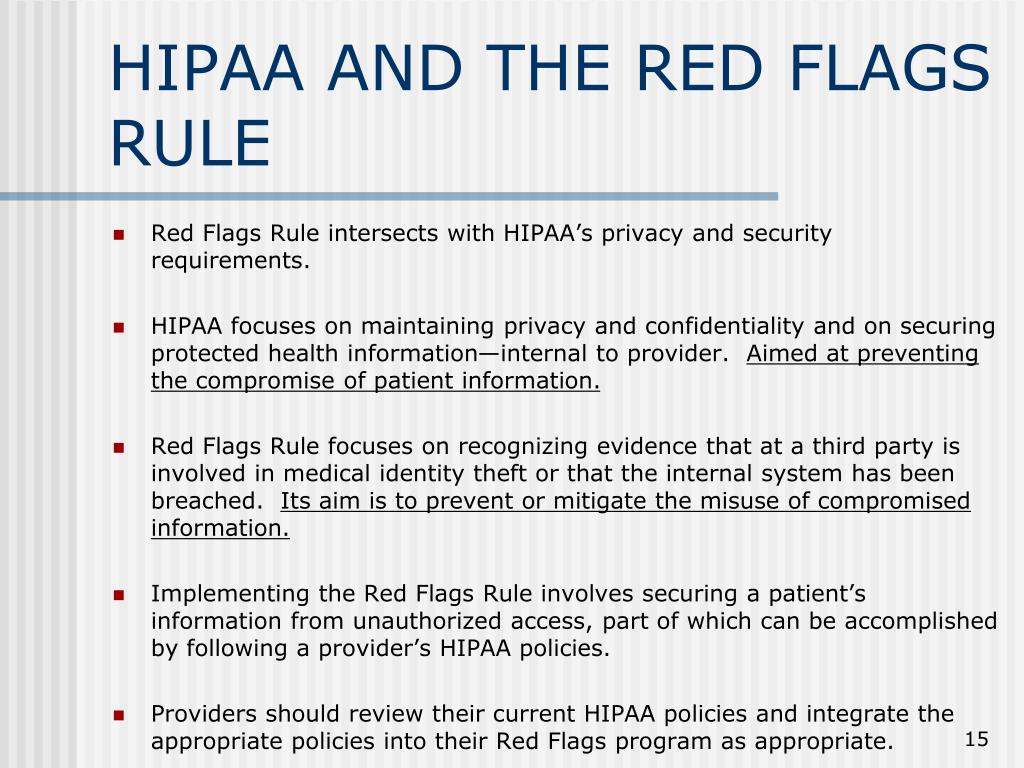

PPT THE FTC “RED FLAGS” RULE PowerPoint Presentation, free download

Red Flag Rules Banking on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. learn about the 26 red flags that indicate possible identity theft and how to respond to them. on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. the red flags rule requires each financial institution and creditor that holds any consumer account, or other.

From www.pinterest.com

Make your AML (AntiMoney Laundering) programs more effective by Red Flag Rules Banking learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. learn about the 26 red flags that indicate possible identity theft and how to respond to them. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. the red. Red Flag Rules Banking.

From fabalabse.com

How do banks know red flags? Leia aqui How do you identify red flags Red Flag Rules Banking learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft.. Red Flag Rules Banking.

From www.slideserve.com

PPT “FACTA'S RED FLAG RULES” Unraveling the mystery and brief Red Flag Rules Banking learn about the 26 red flags that indicate possible identity theft and how to respond to them. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. the red flags rule requires each financial institution and creditor that holds any consumer account, or other. learn how. Red Flag Rules Banking.

From gvo3.com

Red Flag Rule gvo3 & Associates Red Flag Rules Banking learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. learn how. Red Flag Rules Banking.

From www.fraudfighter.com

Fair and Accurate Credit Transactions Act (FACTA) Red Flag Rules Red Flag Rules Banking the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and.. Red Flag Rules Banking.

From www.slideserve.com

PPT THE FTC “RED FLAGS” RULE PowerPoint Presentation, free download Red Flag Rules Banking learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. learn about the 26 red flags that indicate possible identity theft and how to respond to them. learn how. Red Flag Rules Banking.

From financialcrimeacademy.org

The Red Flag Mechanisms In Banking Identifying And Investigating Red Flag Rules Banking on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. the red flags rule requires each financial institution and creditor that holds any consumer account, or other. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. learn how to choose an. Red Flag Rules Banking.

From blog.finology.in

9 Accounting Red Flags to look out for in Financial Statements Red Flag Rules Banking the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and. learn about the 26 red flags that indicate possible identity theft and how to respond to them. on november. Red Flag Rules Banking.

From www.synovus.com

Infographic How to Spot Red Flags For Banking Scams Synovus Red Flag Rules Banking the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. the red flags rule requires each financial institution and creditor that holds any consumer account, or other. learn how to choose an. Red Flag Rules Banking.

From www.bankwithbos.com

6 Red Flags to Better Protect Your Business from Fraud Bank of Red Flag Rules Banking the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. learn about the 26 red flags that indicate possible identity theft and how to respond to them. the red. Red Flag Rules Banking.

From risala-blog.blogspot.com

Red Flags Rules Are Part Of Risala Blog Red Flag Rules Banking the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. learn about the 26 red flags that indicate possible identity theft and how to respond to them. learn how to choose an. Red Flag Rules Banking.

From www.slideshare.net

FACTA Red Flags Rule Compliance Red Flag Rules Banking the red flags rule requires each financial institution and creditor that holds any consumer account, or other. on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and. the red. Red Flag Rules Banking.

From amlwatcher.com

Red Flag Rules A Roadmap to Financial and Data Vigilance Red Flag Rules Banking on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. the red. Red Flag Rules Banking.

From www.abc-amega.com

Red Flags Rule Compliance ABCAmega Red Flag Rules Banking the red flags rule requires each financial institution and creditor that holds any consumer account, or other. on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. learn about the 26 red flags that indicate possible identity theft and how to respond to them. learn how to implement a. Red Flag Rules Banking.

From www.slideshare.net

The Red Flags Rule Red Flag Rules Banking the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and.. Red Flag Rules Banking.

From www.slideserve.com

PPT Red Flag Rules Training Class SD 428 PowerPoint Presentation Red Flag Rules Banking the red flags rule requires each financial institution and creditor that holds any consumer account, or other. learn how to implement a written identity theft prevention program to detect and mitigate the warning signs of identity theft. learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and.. Red Flag Rules Banking.

From www.bankinfosecurity.com

Identity Theft Red Flags Rule Compliance Survival Guide Red Flag Rules Banking on november 15, 2007, the fdic issued a final rule and guidelines addressing identity theft red flags,. the red flags rule is a regulation that requires certain businesses and organizations to prevent identity theft. the red flags rule requires each financial institution and creditor that holds any consumer account, or other. learn how to choose an. Red Flag Rules Banking.

From www.uslegalforms.com

Guide to Complying with the Red Flags Rule under FCRA and FACTA Fcra Red Flag Rules Banking learn about the 26 red flags that indicate possible identity theft and how to respond to them. learn how to choose an identity theft protection program that meets the red flag regulations and protects your bank and. the red flags rule requires each financial institution and creditor that holds any consumer account, or other. learn how. Red Flag Rules Banking.